Tax Credit Q&A Event with Lindsey Saul

Free Arizona Tax Credit Q&A Webinar

with Lindsey Saul

& hosted by Child & Family Resources

Wednesday, January 29, 2025

12:00 pm – 12:30 pm

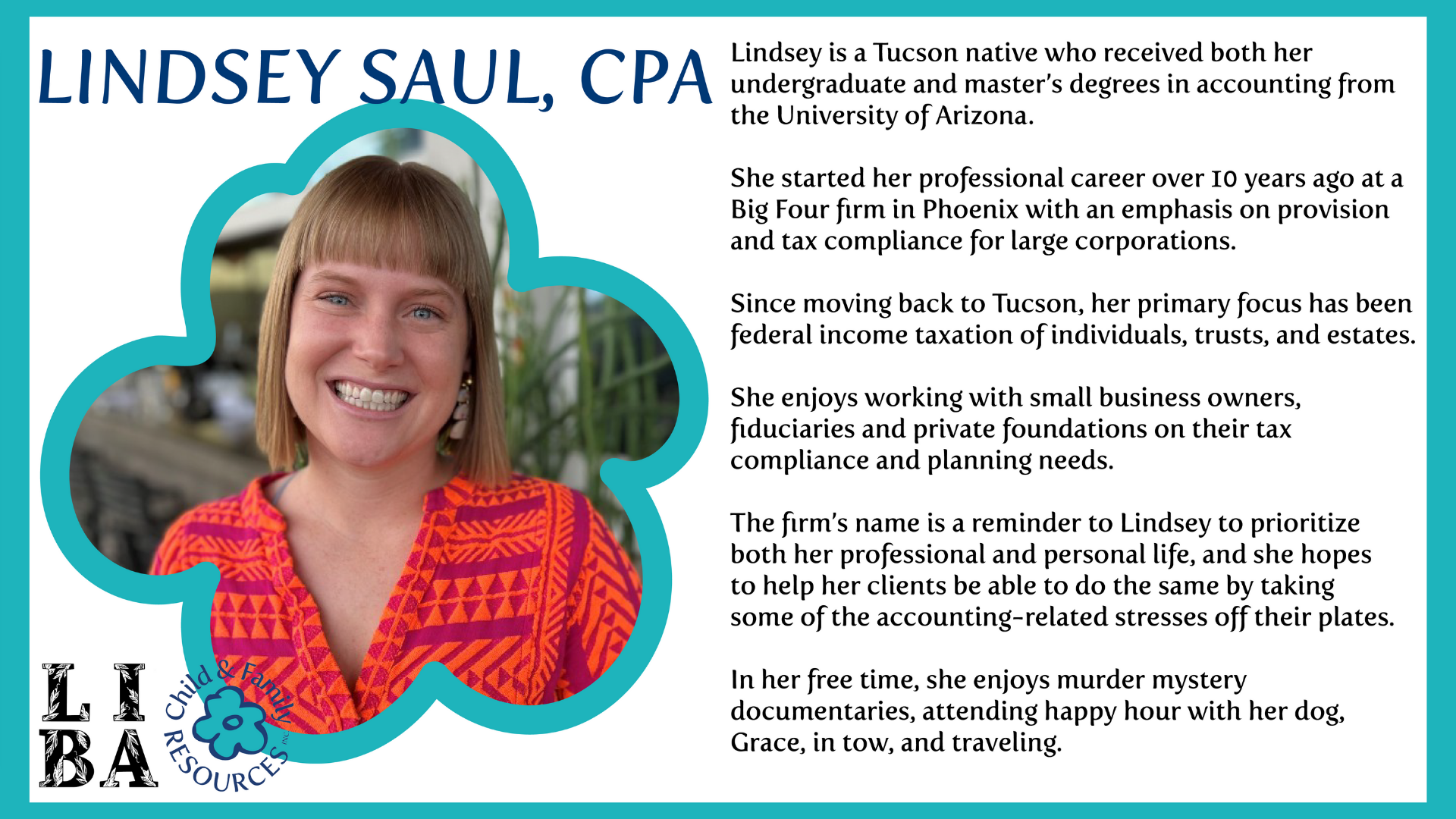

Register today to discover how you can make a difference in your community while benefiting from Arizona tax credits. Learn from the experts at Life in Balance Accounting CPAs, PLC as they provide valuable insights into the Arizona tax credit process, limits, and benefits. Don’t miss this opportunity to maximize your impact and support local programs.

Click here for Free Registration! | Click for more about the Arizona Tax Credit!

Did you know? Any gift made to Child & Family Resources may be claimed on your taxes for the Arizona Charitable Tax Credit. Our tax ID #86-0251984. Total contributions up to $470 for single filers and up to $938 for joint filers to qualifying organizations may qualify. Please support your local community by making a donation to Child & Family Resources.